nly stock dividend safe

Data is currently not available. Our Dividend Growth Score answers the question How fast is the dividend likely to grow It considers many of the same fundamental factors as the Safety Score but places more weight on growth-centric metrics like sales and earnings growth a.

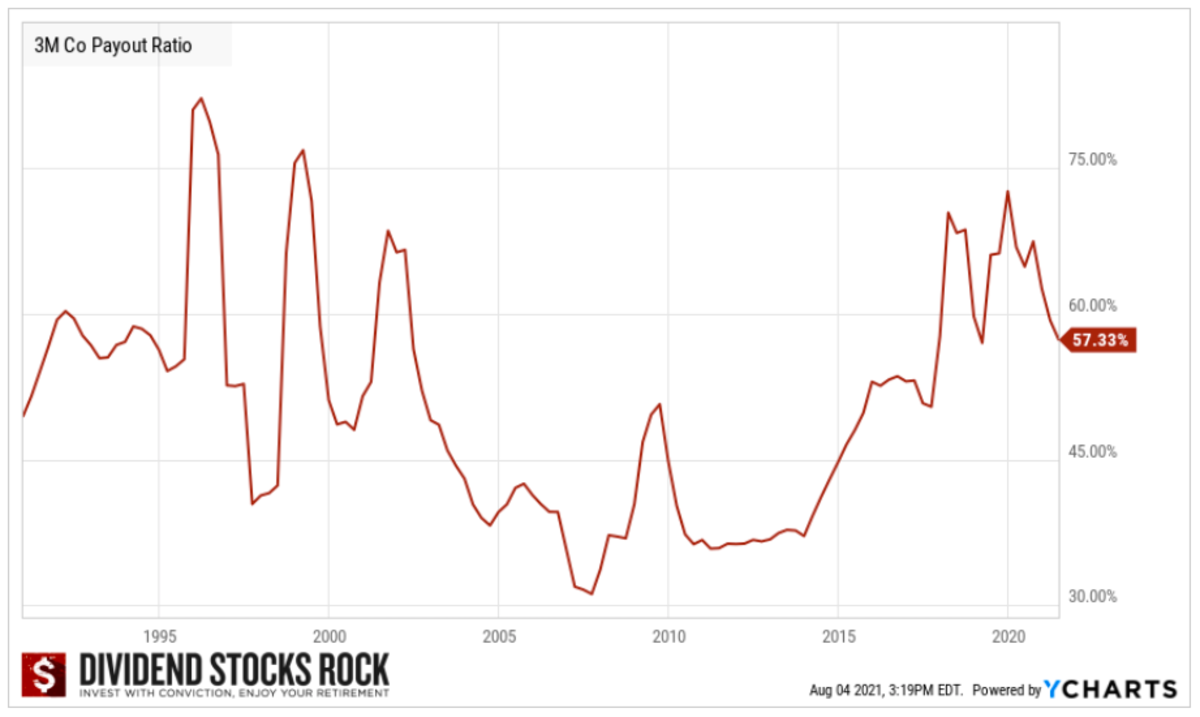

What Is A Good Payout Ratio For Dividend Stocks Dividend Strategists

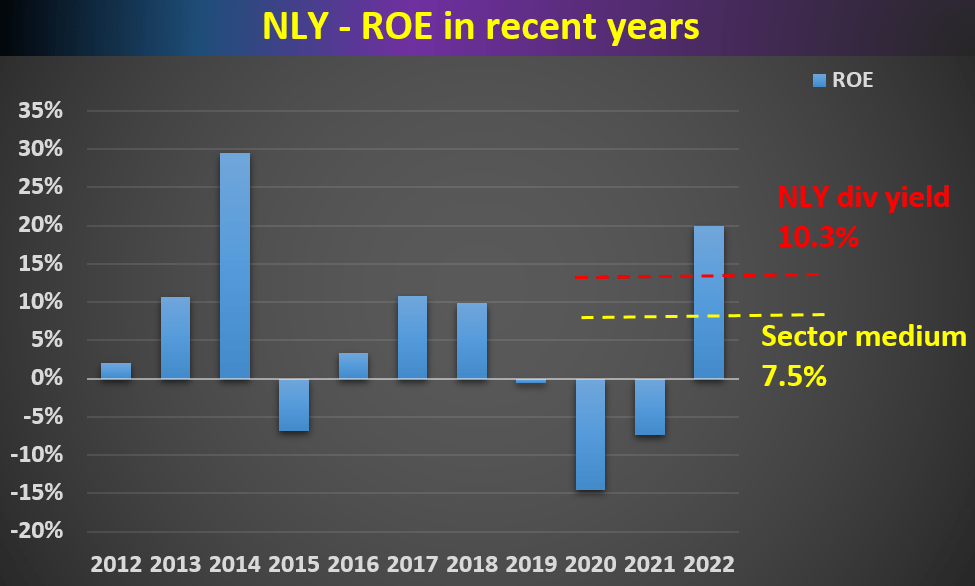

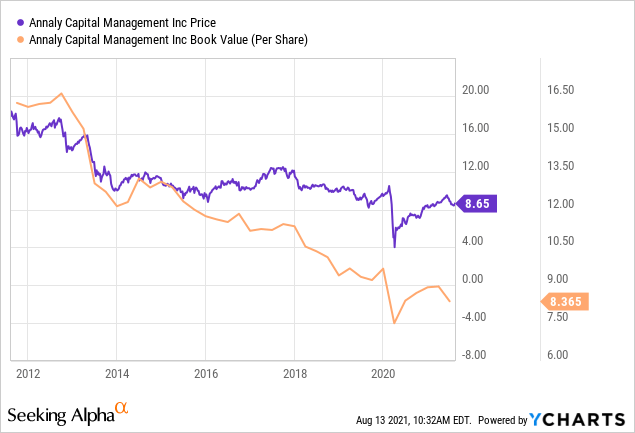

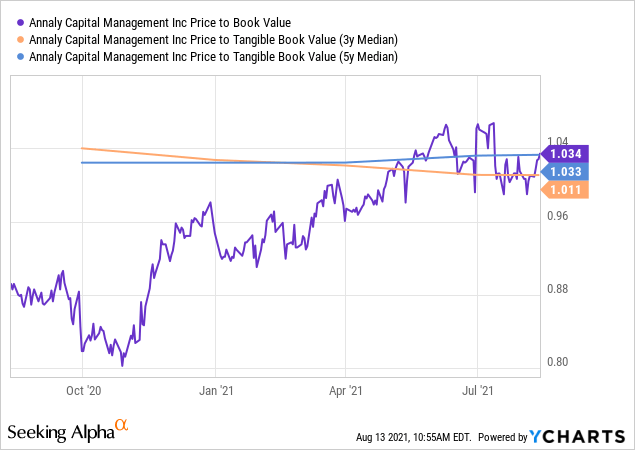

By comparison the average stock in Dividend Channels coverage universe yields 31 percent and trades at a price-to-book ratio of 27 while NLYs latest share price of 922 reflects a price-to-book ratio of 10 and an annual dividend yield of 954 percent.

. Annaly Capital Management NLY-113 is offering investors a huge 10 dividend yield today. NLY dividend safety metrics payout ratio calculation and chart. -015 -216 DATA AS OF Feb.

NLY 703 down 007. NLY is one of the most requested stocks in the Safety Net column. However ORC has been paying out that 8 cents per quarter since mid.

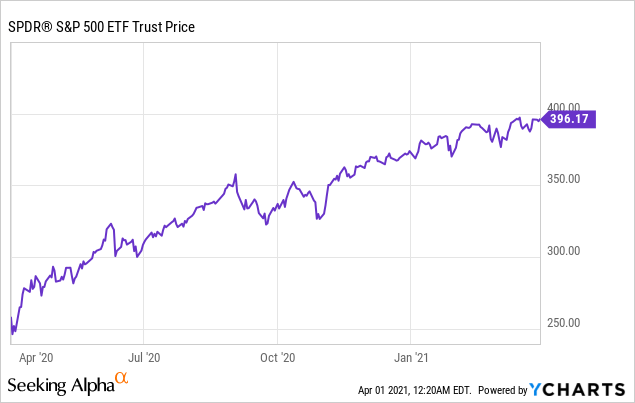

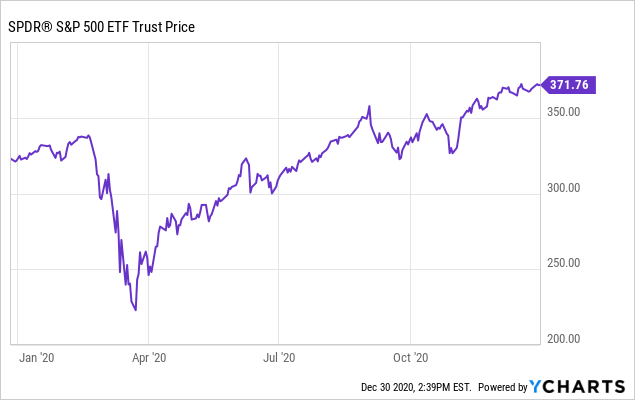

Annaly Capital Management NLY currently yields 1475. To grasp just how big that is the SP 500 Index is. Buy NLY shares 1 day before the ex-dividend date.

Annaly Capital Management Inc. Real estate investment trusts REITs routinely have high dividend yields and Annaly Capital Management NYSENLY is one such stock with a yield that appears high but is actually quite safe and manageable. But is that nearly double-digit yield safe.

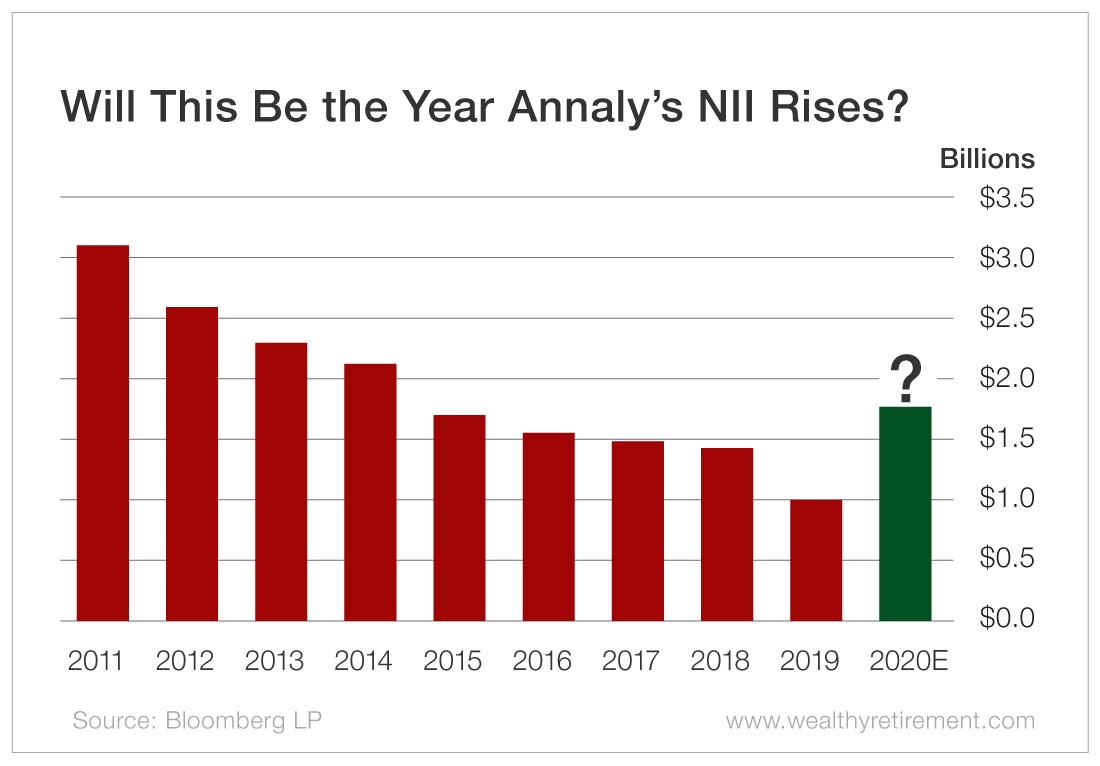

In February I analyzed the dividend safety of Annaly Capital Management NYSE. The first ultra-high-yield dividend stock you can buy hand over fist if you want a mountain of annual dividend income is Annaly Capital Management. 8627 based on next years estimates.

Annaly Capital Management Inc Common Stock NLY Annaly Capital Management Inc Common Stock. 4924 based on cash flow. The main takeaway is that NLYs 10-plus dividend yield is safe and it represents an attractive opportunity for mREIT investors.

A C is better than a D. NLY one of the most frequently requested stocks in the Safety Net column. Is NLY stock dividend safe.

That triggered a sell-off sending NLY stock cratering five percent in value. As an investor you want to. Ad Cabot expert on dividend stocks will tell you where to find them and what to look for.

Purchase date estimate Apr 29 2022. A B is better than a C. To get the cash flow to pay the big yield the company reported economic leverage of 68 times for the 2020 first quarter.

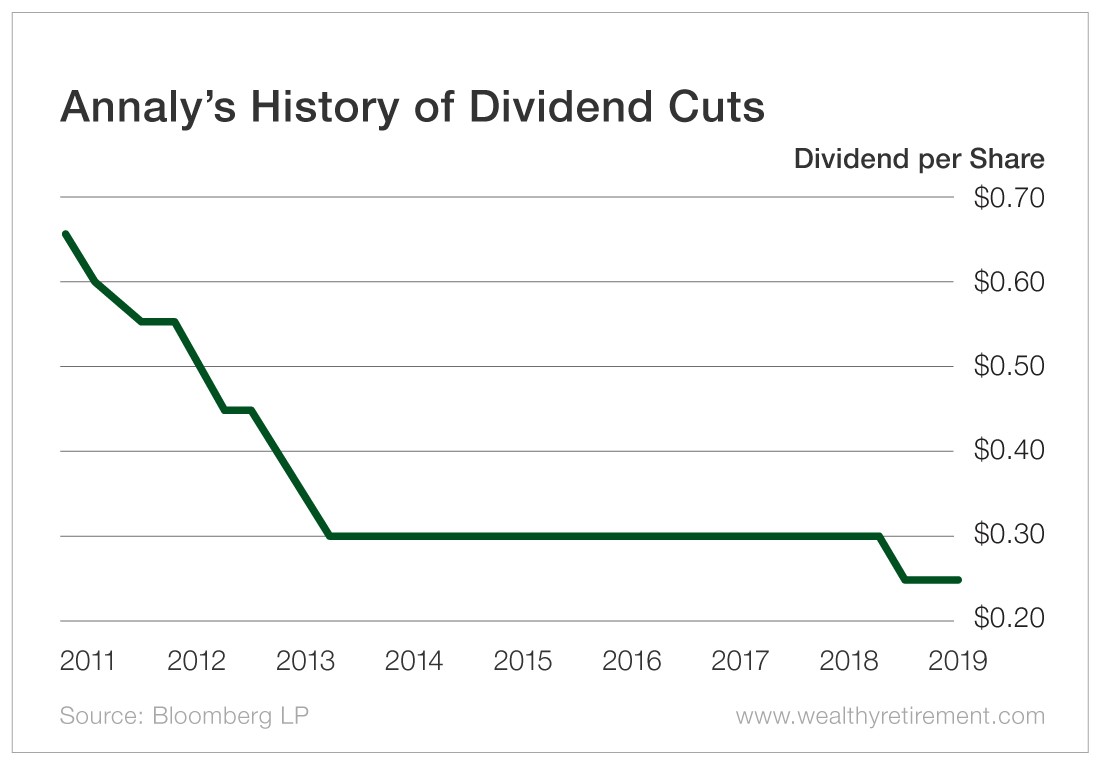

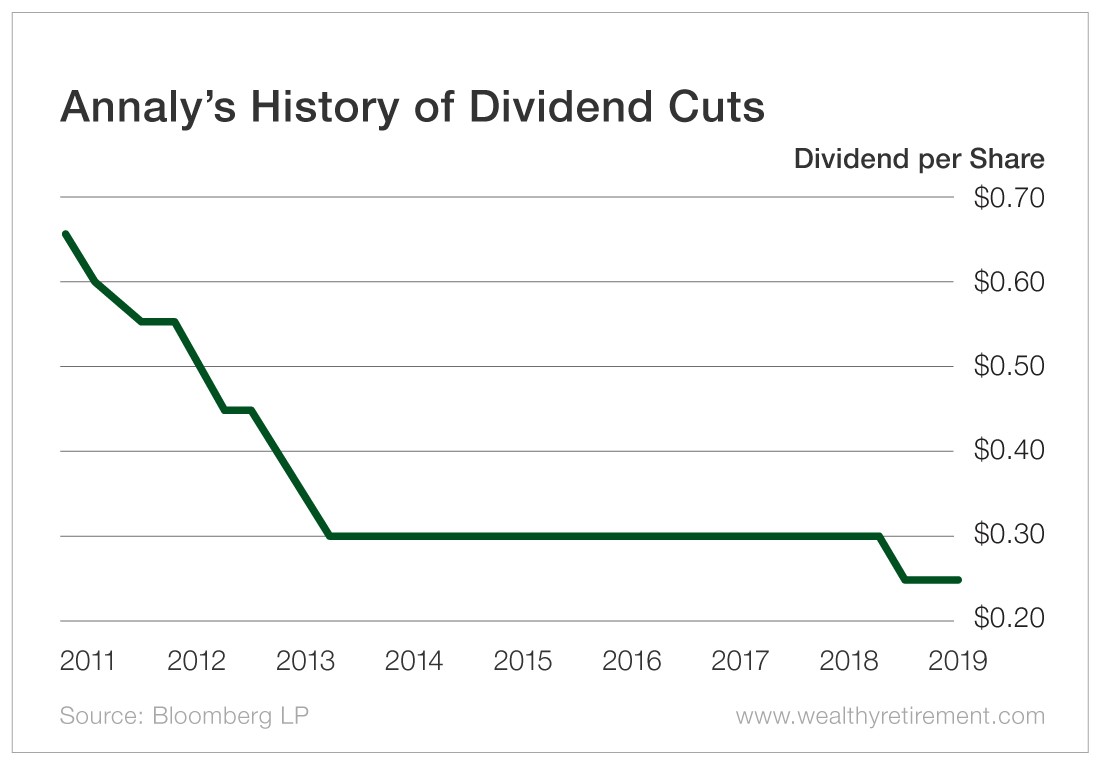

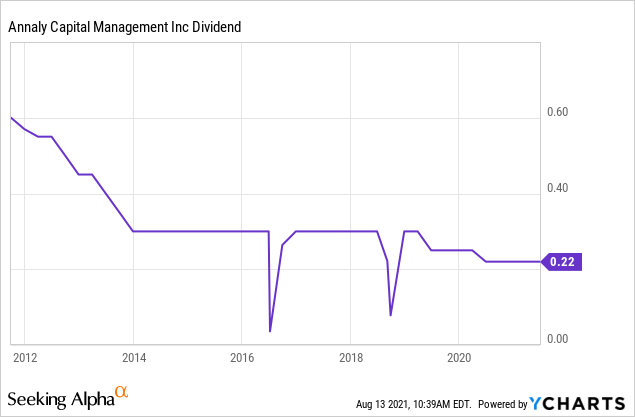

If NLY is the safe pickthen ORC is the risky one. For 2020 analysts estimate that Annalys core earnings will come in at 106 per share. Last week Annaly Capital Management NLY announced plans to cut its dividend by 17 beginning with its second-quarter payout.

After all Annalys earnings about matched its dividend payment in recent quarters the firms portfolio was growing at a double-digit pace shares. This is a stock I get a lot of questions about from my Dividend Hunter readers. At the time I said that until the company proves it can lift net interest income above how much it pays in dividends it gets a very solid F rating.

Over the same period the business will pay out 100 per share in distributions. And a D is better than an F. Is nly a buy right now.

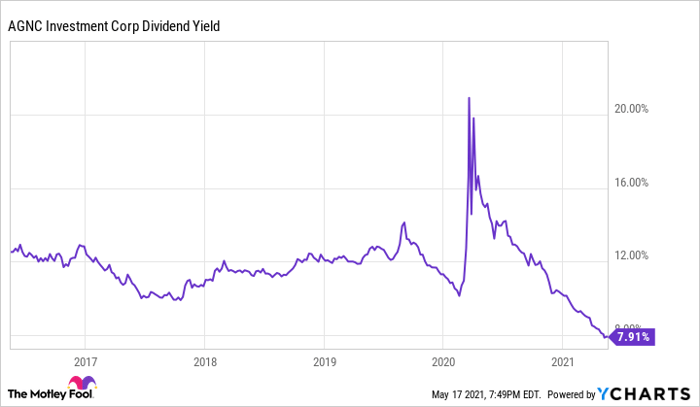

Thats not a shock considering its attractive 99 dividend yield. That distribution cut however has left the firm in a more sustainable financial position. NLY is even more appealing than AGNC in terms of dividend yield as its forward yield is a whopping 96.

Annaly Capital Management NYSE. Ad 1000 Strong Buy Stocks that Double the SP. 9072 based on this years estimates.

The timing of this announcement likely came as a surprise to some income investors. That has also culminated in ORCs dividend being cut from 14 cents per quarter in the past to the current 8. The dividend payout ratio for NLY is.

However the predicted payout ratio of 84 percent in 2021 is far less cautious and the book value per share growth of only 03 percent in Q1 is significantly lower than AGNCs. 5466 based on the trailing year of earnings. A year and a half ago I suggested that despite its F rating for dividend safety Annaly could receive an upgrade if its net interest income NII increases to.

Annaly Capital Management has received a consensus rating of Buy. An A is better than a B. Learn why dividend stocks have been one of the most successful wealth building investments.

Thats because when you get past their savory 1589 dividend yield you find a sour history of earnings decline. Ad Ex-dividend Date Monthly Did Payments Stock Schedules.

Annaly Capital Management Dividend Safety

5 Monthly Dividend Stocks To Watch Right Now Nasdaq

Annaly Capital Safe 10 Plus Dividend Yield Nyse Nly Seeking Alpha

Ex Dividend Reminder Servisfirst Bancshares Annaly Capital Management And Rexford Industrial Realty Nasdaq

Why Annaly Capital Management Is A Top 10 Reit Stock With 9 54 Yield Nly Nasdaq

Here S 1 High Yield Dividend Stock You Can Trust Nasdaq

Why I Ll Never Own Annaly Capital Management Reit The Motley Fool

Annaly Capital Management Dividend Safety Investment U

Annaly Capital Management Dividend Safety

Here S 1 High Yield Dividend Stock You Can Trust The Motley Fool

Is Annaly Capital A Good Stock To Buy What To Consider Nyse Nly Seeking Alpha

Is Annaly Capital A Good Stock To Buy What To Consider Nyse Nly Seeking Alpha

Is Annaly Capital Management Stock A Buy The Motley Fool

Is Annaly Capital A Good Stock To Buy What To Consider Nyse Nly Seeking Alpha

Nly 8 Extreme Dividend Stocks Between 11 To 15 Yields

5 Safe And Cheap Dividend Stocks To Invest In April 2021 Seeking Alpha

5 Safe And Cheap Dividend Stocks To Invest In January 2021 Seeking Alpha

High Dividend Stocks Price To Earnings Ratio Dividend Stocks Dividend Stocks Today

Since My Divorce I Have Been Studying The Stock Market Of Dividend Funds I Like Nly I Don T Really Know What It Is But It Is But I Think The Dividend Is